ELECTRIC ROYALTIES LTD. (:ELEC) Electric Royalties Enters Into Definitive Agreement to Acquire 0.75% Gross Revenue Royalty on Producing Punitaqui Copper Mine in Chile

Transparency directive : regulatory news

COMPANY DETERMINES NOT TO PROCEED WITH PREVIOUSLY ANNOUNCED MINERA COBRE VERDE COPPER STREAM

VANCOUVER, BC / ACCESSWIRE / November 22, 2024 / Electric Royalties Ltd. (TSXV:ELEC)(OTCQB:ELECF) ("Electric Royalties" or the "Company") is pleased to announce that the Company has entered into a definitive agreement with Battery Mineral Resources Corp. ("BMR") (TSXV: BMR) (OTCQB: BTRMF), Minera BMR SpA ("Minera BMR") and Minera Altos De Punitaqui Limitada (together, the "Vendors"), dated November 22, 2024, to acquire a 0.75% Gross Revenue Royalty (the "0.75% GRR") on the producing Punitaqui copper mine in Chile (the "Project" or "Punitaqui") in exchange for a cash payment of C$3,500,000 (the "Transaction").

Brendan Yurik, CEO of Electric Royalties, commented: "The Punitaqui copper mine is well positioned to continue increasing its production and executing key capital projects, thanks to this infusion of Electric Royalties' capital.

"Under the ownership of prior companies, the mine first went into production in 2010 and operated successfully until it was put into care and maintenance in 2020, when copper prices averaged less than US$3.00 per pound and silver prices averaged approximately US$20.50 per ounce. We feel the combination of BMR's ownership, higher copper, gold and silver prices, production from the mines and processing of mineralized material sourced both from the mines and from third-parties, could translate into increased operating margins for the project.

"Punitaqui is a project that has four satellite copper resources, excellent road access and ready availability of water and power. It also possesses crucially important fixed assets, infrastructure and key permits.

"Management of the Company believes Punitaqui represents an opportunity for sustainable copper production and revenue to the Company in the near term. The demand for copper is poised to increase due to the accelerating global transition towards clean energy and the growth of artificial intelligence data centers1. Through this royalty acquisition, Electric Royalties is investing in a project that could help supply the growing demand for copper while capitalizing on rising copper prices."

Detailed terms and conditions of the Transaction are set out below in the "Transaction Terms" section.

Punitaqui Copper Royalty Acquisition Highlights2

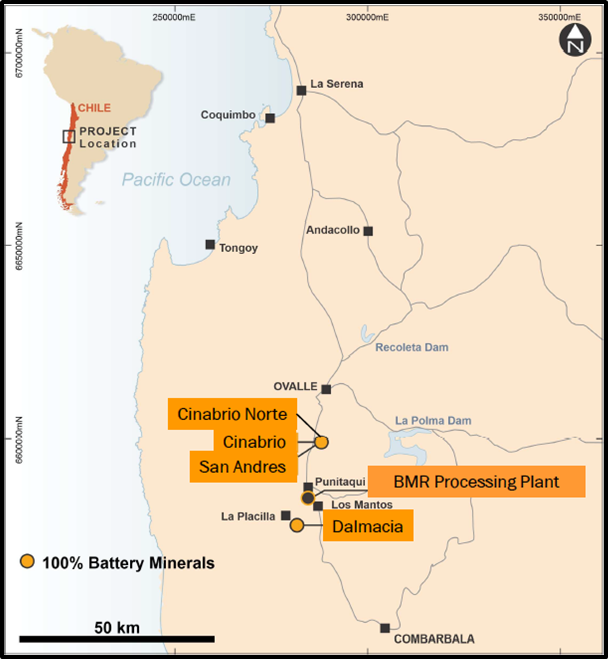

The Punitaqui Project is located 120 kilometers south of La Serena city and the port of Coquimbo, Chile.

The mine's processing plant is centrally located and is proximal to four of Punitaqui's satellite copper resources - San Andres, Cinabrio, Cinabrio Norte, and Dalmacia.

Copper concentrate is produced from processing mineral feed from Punitaqui mines, supply from third-party mines and also copper smelting by-products (slags) supplied by an external party. Processing operations resumed on May 13, 2024, after the successful commissioning of the recently refurbished and upgraded mineral processing facility.

The original underground mine, Cinabrio, was historically the source of feed to the processing plant for over 10 years during which it was operated primarily by Glencore plc, and has remaining copper resources to be mined and opportunities for additions to the current resource via the active underground drilling program.

The San Andres mine has existing underground access, and hosts an underground indicated sulphide resource of 1.74 million tonnes grading 1.06% CuT (copper) and 4.83 grams per tonne silver at a cut-off of 0.7% CuT3.

Mining activities to establish access to the mineralized zones at Cinabrio, San Andres and Cinabrio Norte continue to ramp up with stockpiling of fresh mineralized material at the mill. The timeline from first fresh mineralized material through the mill (May 2024) to approximately 90,000 tonnes per month, is expected to take approximately nine months. BMR expects that the Punitaqui full annual copper production rate will be in the range of 19 million to 23 million pounds of copper in concentrate2.

BMR is executing underground infill and extensional drilling at Cinabrio and San Andres mines. The drilling program is designed to further delineate areas that are included in near-term mine sequencing, and for grade control purposes.

While the Cinabrio and San Andres mines continue to increase production, BMR endeavours to utilize the full permitted capacity of the processing plant by also processing mill feed from outside sources.

Additionally, development is advancing towards the Cinabrio Norte mine, the northern extension of the Cinabrio deposit, with plans to commence production of mineralized material from Cinabrio Norte in H2 2025.

The presence of regional targets and potential extensions to established targets such as the Cinabrio Norte zone, suggest there is near-term local exploration potential.

The Dalmacia mine is planned to be a significant addition to the sequence of mineralized material to the processing facility and has underground access and hosts an underground indicated sulphide resource of 2.19 million tonnes grading 1.00% CuT (copper) and 1.38 grams per tonne silver at a cut-off of 0.7% CuT3.

Figure 1: Map showing the Punitaqui Copper Project in Chile

Figure 2: The Punitaqui Mining Complex, which includes the copper processing plant that is currently permitted for 100,000 tonnes per month

Punitaqui Project Overview3

The Punitaqui mining complex is in the central part of Coquimbo region about 120 kilometers (km) south of the port city of La Serena, Chile. Shipping is available via La Serena and the nearby port town of Coquimbo. The region is well serviced by grid electrical power and telecommunication services.

The property consists of 3 main blocks over a 30-km north-south corridor with a centrally located plant complex. A well-established road network connects the processing plant, the Cinabrio mine, San Andres mine, Cinabrio Norte mine and the Dalmacia mine. The Cinabrio mine is located approximately 25 km by road, north of the processing plant. The Dalmacia mine is about 12 km by road to the south of the processing plant. Surface haulage from the outlying properties is accomplished using 20 to 25-tonne trucks.

Current Mineral Resources include 6.17 million tonnes in the Indicated category grading 1.14% copper and 2.48 grams per tonne silver, and 3.07 million tonnes in the Inferred category grading 0.93% copper and 2.64 grams per tonne silver at a 0.7% copper cut-off grade3. The resources occur within four deposits: Cinabrio, San Andres, Dalmacia and Cinabrio Norte.

Geology

Northern Chile is one of the world's most well-endowed mineral districts. The regional bedrock geology of the Punitaqui-Ovalle region consists of a Jurassic to lower Cretaceous age sequence of volcanic rocks (lavas, conglomerates and andesitic breccias) with interbedded marine sediments (shales, fossiliferous limestones, and thin layers of sandstones). This sequence has been locally intruded by dioritic to granodioritic rocks of Upper Cretaceous age. Andesitic to dacitic dykes ranging in age from Cretaceous to Tertiary are common in the region. The lower elevations in the region are commonly covered by Quaternary alluvial deposits which locally extensively obscure the underlying Mesozoic bedrock.

The Punitaqui region hosts iron oxide copper-gold (IOCG) type mineralization, manto-style copper mineralization, and mesothermal vein hosted copper and lode style, narrow vein gold mineralization. In northern Chile, manto-style mineralization is the most economically significant. Cinabrio, San Andres, Dalmacia and Cinabrio Norte are manto-style copper occurrences. Manto-style copper mineralization at Punitaqui is hosted by a regionally extensive marine sedimentary rock unit within an andesitic volcanic sequence. The sedimentary rock unit is comprised of dark-coloured shales, volcanoclastic sandstones, volcanoclastic sedimentary breccia and conglomerates and fossiliferous limestones.

Transaction Terms

For the payment of total consideration of C$3,500,000 in cash, Electric Royalties is acquiring the 0.75% GRR on the mining claims, mining leases and mineral tenures comprising the Punitaqui copper mine. In addition, the 0.75% GRR would apply to third-party materials processed through the Punitaqui mining complex from the effective date to December 31, 2027. C$3,050,000 of the purchase price for the 0.75% GRR is payable on closing of the Transaction, and the remaining C$450,000 is payable within 45 days of closing.

The Vendors have the right to buy back 0.375% GRR of the 0.75% GRR for a cash payment of USD$1,500,000 once the Vendors have made royalty payments to the Company in excess of C$4,000,000.

Completion of the proposed Transaction remains subject to a number of conditions, including: the receipt of any required regulatory and TSX Venture Exchange approvals, and other customary closing conditions.

The Company intends to draw down C$3,050,000 from its amended and restated convertible credit facility (the "Facility") with Gleason & Sons LLC ("Gleason") dated February 16, 2024, and consider other financing sources, as needed, to fund the remainder of the Transaction costs. In addition to granting security to Gleason in the 0.75% GRR, the Company has determined to include its 1% gross metal royalty on the Mont Sorcier Project in Québec as additional collateral for the Facility, in accordance with the Facility and associated security agreement. Gleason is controlled by the Company's largest shareholder and the Facility permits the Company to defer all interest payments until maturity in 2028.

Update on Minera Cobre Verde Copper Stream

Further to the Company's news release dated September 18, 2024, the Company announces that it has determined not to proceed with the previously announced copper stream with Minera Cobre Verde (a subsidiary of Cobre y Metales) regarding the proposed copper stream on the Minera Cobre Verde Mine in Chile described in such news release.

David Gaunt, P.Geo., a Qualified Person who is not independent of Electric Royalties, has reviewed the technical information in this release.

1 https://carboncredits.com/will-ai-drive-a-global-copper-shortage-bhp-rings-the-alarm/

2 Battery Mineral Resources Corp. news release dated May 13, 2024; Battery Mineral Resources Corp. website https://bmrcorp.com/projects/projects-map/

3 Scientific and technical information pertaining to the Punitaqui Resource was extracted from Battery Mineral Resources Corp.'s NI 43-101 "Technical Report on Punitaqui Copper Complex Coquimbo, Chile" dated as of September 30, 2022 with an effective date of August 16, 2022, prepared by Garth Kirkham (Kirkham Geosystems Ltd.) an independent Qualified Person in accordance with NI 43-101. All mineral resources have been estimated in accordance with Canadian Institute of Mining and Metallurgy and Petroleum ("CIM") definitions, as required under NI 43-101. Cut-off grades are based on a price of US$3.50/lb copper, US$20/oz silver and several operating costs, metallurgical recoveries, and recovery assumptions, including a reasonable contingency factor.

About Electric Royalties Ltd.

Electric Royalties is a royalty company established to take advantage of the demand for a wide range of commodities (lithium, vanadium, manganese, tin, graphite, cobalt, nickel, zinc and copper) that will benefit from the drive toward electrification of a variety of consumer products: cars, rechargeable batteries, large scale energy storage, renewable energy generation and other applications.

Electric vehicle sales, battery production capacity and renewable energy generation are slated to increase significantly over the next several years and with it, the demand for these targeted commodities. This creates a unique opportunity to invest in and acquire royalties over the mines and projects that will supply the materials needed to fuel the electric revolution.

Electric Royalties has a growing portfolio of 40 royalties in lithium, vanadium, manganese, tin, graphite, cobalt, nickel, zinc and copper across the world. The Company is focused predominantly on acquiring royalties on advanced stage and operating projects to build a diversified portfolio located in jurisdictions with low geopolitical risk, which offers investors exposure to the clean energy transition via the underlying commodities required to rebuild the global infrastructure over the next several decades toward a decarbonized global economy.

For further information, please contact:

Brendan Yurik

CEO, Electric Royalties Ltd.

Phone: (604) 364‐3540

Email: Brendan.yurik@electricroyalties.com

https://www.electricroyalties.com/

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange), nor any other regulatory body or securities exchange platform, accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward-Looking Information and Other Company Information

This news release includes forward-looking information and forward-looking statements (collectively, "forward-looking information") with respect to the Company within the meaning of Canadian securities laws. This news release includes information regarding other companies and projects owned by such other companies in which the Company holds a royalty interest, based on previously disclosed public information disclosed by those companies and the Company is not responsible for the accuracy of that information, and that all information provided herein is subject to this Cautionary Statement Regarding Forward-Looking Information and Other Company Information.Forward looking information is typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. This information represents predictions and actual events or results may differ materially. Forward-looking information may relate to the Company's future outlook and anticipated events and may include statements regarding the projected future production, financial results, future financial position, expected growth of cash flows, business strategy, budgets, projected costs, projected capital expenditures, taxes, plans, objectives, industry trends and growth opportunities of the Company and the projects in which it holds royalty interests.

Although the Punitaqui Project is a past producer with significant infrastructure still in place, the projected production and production decision by Battery Mineral Resources is not based on a feasibility study of mineral reserves demonstrating current economic and technical viability of the Punitaqui Project and furthermore Electric Royalties is not aware of any preliminary economic assessment or other study having been completed in respect of the projected production or production decision by Battery Mineral Resources with respect to the Punitaqui Project. As such, there is a higher degree of risk and uncertainty associated with the production decision, including increased uncertainty of achieving any particular level of production or recovery of minerals or the cost of such production or recovery. Historically, projects that are not based on a feasibility study have a much higher risk of economic and technical failure. There is no guarantee that production will begin as anticipated or at all or that anticipated production costs will be achieved. A failure to commence or maintain production at the Punitaqui Project would adversely impact Electric Royalties' potential future cash flow and profitability.

While management considers these assumptions to be reasonable, based on information available, they may prove to be incorrect. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company or these projects to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These risks, uncertainties and other factors include, but are not limited to risks associated with general economic conditions; adverse industry events; marketing costs; loss of markets; future legislative and regulatory developments involving the renewable energy industry; inability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favourable terms; the mining industry generally, recent market volatility, income tax and regulatory matters; the ability of the Company or the owners of these projects to implement their business strategies including expansion plans; competition; currency and interest rate fluctuations, and the other risks.

The reader is referred to the Company's most recent filings on SEDAR+ as well as other information filed with the OTC Markets for a more complete discussion of all applicable risk factors and their potential effects, copies of which may be accessed through the Company's profile page at sedarplus.ca and at otcmarkets.com.

SOURCE: Electric Royalties Ltd.

View the original press release on accesswire.com

source : webdisclosure.com