LI-FT POWER LTD. (:LIFT) LIFT Announces Initial Mineral Resource of 50.4 Million Tonnes at 1.00% Li2O, at the Yellowknife Lithium Project, NWT, Canada

Transparency directive : regulatory news

Highlights:

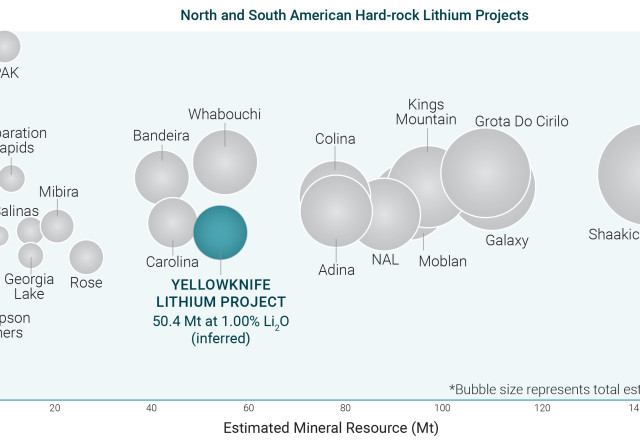

The maiden resource estimate at the Yellowknife Lithium Project represents the 3rd largest hard-rock maiden resource estimate in Canada and the 10th largest hosted in the Western Hemisphere.

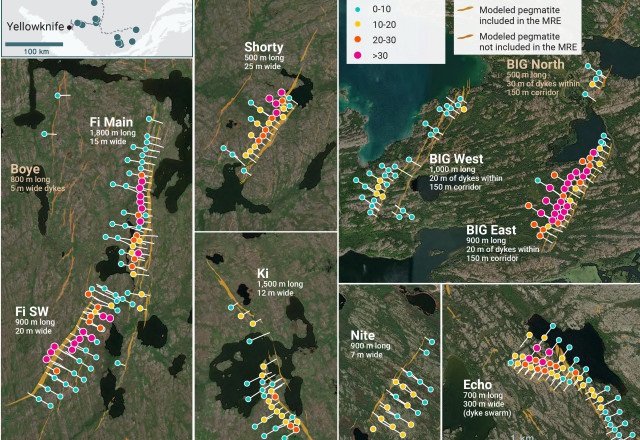

6 of the 8 spodumene dykes included in the maiden resource estimate have unconstrained mineralization, providing significant opportunity for growth.

5 undrilled spodumene dykes hosted within the Yellowknife Lithium Project that were not included in the maiden resource estimate have excellent potential to further expand the resource profile.

The maiden resource estimate is only based on 10 months and 49,548 m of drilling (286 drill holes from June 2023 to April 2024).

The maiden resource estimate further positions the Yellowknife Lithium Project as a globally significant source of spodumene and will underpin a preliminary economic assessment that is on track to be completed in Q2 2025.

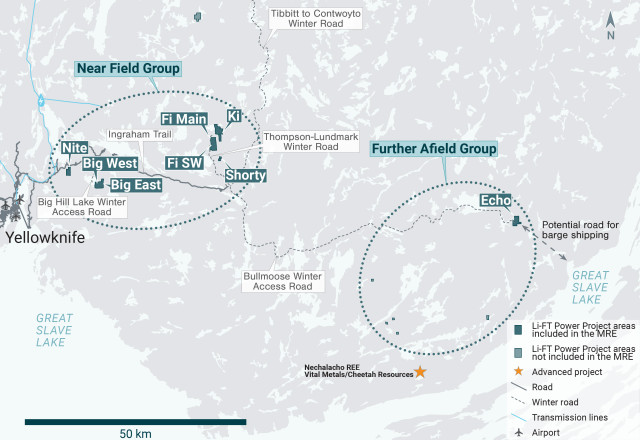

Excellent access to infrastructure, including the Ingraham Trail running through part of the mineral resource, proximity to rail at Hay River, existing powerlines outside of Yellowknife, and access to major ports in Prince Rupert and Vancouver for shipment to Asian markets.

The x-ray diffraction analysis and pilot-scale testing completed as part of the Yellowknife Lithium Project metallurgical program (see press release dated September 23, 2024) provides confirmation of simple lithium mineralogy and that low-cost dense medium separation ("DMS") is suitable for the spodumene dykes included the maiden resource estimate.

VANCOUVER, BC / ACCESSWIRE / October 1, 2024 / Li-FT Power Ltd. ("LIFT" or the "Company") (TSXV:LIFT)(OTCQX:LIFFF)(Frankfurt:WS0) is pleased to announce the initial (i.e. first) National Instrument 43-101 ("NI 43-101") compliant mineral resource estimate ("MRE") for the Yellowknife Lithium Project ("YLP"), located in the Northwest Territories. The mineral resource estimate covers 8 of 13 spodumene-bearing pegmatite dykes that comprise LIFT's YLP (Figure 1). The consolidated in-pit MRE is reported at 50.4 million tonnes (Mt) grading 1.00% Li2O for 506,000 tonnes of Li2O (1.25 million tonnes of LCE) in the inferred category and will form the basis of a Preliminary Economic Assessment (PEA) targeted for delivery in Q2 2025.

Figure 1 - Location of LIFT's Yellowknife Lithium Project. Drilling has been thus far mainly focused on the Near Field Group of pegmatites which are located to the east of the city of Yellowknife along a government-maintained paved highway, and advancing to the Echo target, the first drilling in the Further Afield Group.

Francis MacDonald, CEO of LIFT comments, "The announcement of Li-FT's first NI 43-101 mineral resource estimate for the Yellowknife Lithium Project marks a significant milestone for both the Company and the Northwest Territories. With an estimated 50.4 million tonnes at a grade of 1.00% Li₂O based only on the initial drilling program, the Yellowknife Lithium Project already ranks among the top 10 largest spodumene projects in the Americas. The majority of the deposits included in the MRE have not yet been constrained by the drilling completed to-date and have excellent potential to significantly grow through further drill programs. This resource will be pivotal in advancing the PEA we are targeting for Q2 2025."

Table 1-Yellowknife Lithium Project Deposit In-pit Mineral Resource Estimate

Cut-off Grade (Li2O%) | Pegmatite Deposit | Tonnes | Li2O Grade (%) | Li2O (t) | LCE (t)* | Resource Classification |

|

|

|

| |||||||

0.4 | Big East, Fi Main and Fi SW | 30,265,000 | 1.05 | 317,000 | 784,000 | Inferred |

|

|

0.5 | Big West, Nite, Shorty, Echo and Ki | 20,118,000 | 0.94 | 189,000 | 467,000 | Inferred |

|

|

|

| |||||||

Total |

| 50,383,000 | 1.00 | 506,000 | 1,251,000 |

|

|

|

* Lithium carbonate equivalent ("LCE")

Yellowknife Lithium Project Mineral Resource Estimate Notes:

The Mineral Resource Estimate (MRE) was estimated by Allan Armitage, Ph.D., P. Geo. of SGS Geological Services, an independent Qualified Person as defined by NI 43-101.

The classification of the current MRE into Inferred mineral resources is consistent with current 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves.The effective date for the Mineral Resource Estimate is September 25, 2024.

All figures are rounded to reflect the relative accuracy of the estimateand numbers may not add due to rounding.

The mineral resource is presented undiluted and in situ, constrained by continuous 3D wireframe models, and are considered to have reasonable prospects for eventual economic extraction.

Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that most Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

The YLP MRE is based on a validated database which includes data from 286 surface diamond drill holes totaling 49,548 m. The resource database totals 10,842 assay intervals representing 10,846 m of drilling. The average assay sample length is 1.00 m.

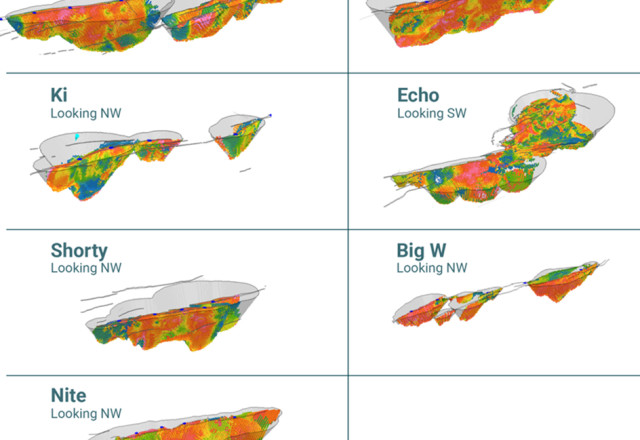

The MRE is based on 126 three-dimensional ("3D") pegmatite resource models, constructed in Leapfrog, representing the Big East, Big West, Fi Main, Fi SW, Nite, Shorty, Echo and Ki pegmatite deposits. Li2O grades were estimated for each mineralization domain using 1.0 metre composites. To generate grade within the blocks, the inverse distance squared (ID2) interpolation method was used for all deposits.

Average density values were assigned to pegmatite and waste domains based on a database of 2,062 samples.

Li-FT envisions that the YLP deposits may be mined using open-pit mining methods. Mineral resources are reported at a base case cut-off grade of 0.40 to 0.50% Li2O. The in-pit Mineral Resource grade blocks are quantified above the base case cut-off grades, above the constraining pit shell, below topography, and within the constraining mineralized domains (the constraining volumes).

The results from the pit optimization are used solely for the purpose of testing the "reasonable prospects for economic extraction" by an open pit and do not represent an attempt to estimate mineral reserves. There are no mineral reserves on the Property. The results are used as a guide to assist in the preparation of a Mineral Resource statement and to select an appropriate resource reporting cut-off grade.

The base-case Li2O Cut-off grade considers the following assumptions: a lithium concentrate (5.5% Li2O) price of US$920/t, a mining cost of US$3.25/t mined, processing, treatment, refining, G&A and transportation cost of USD$19.50/t of mineralized material, metallurgical DMS recovery of 60% was assumed, as were pit slope angles of 60º and mining loss and dilution of 5% and 5%.

The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

Figure 2 - Scatterplot of spodumene projects in the Americas (MRE vs. Grade). After only 10 months of drilling, the estimated 50.4 million tons at a grade of 1.00% Li₂O, ranks the YLP project as one of the top 10 largest spodumene project in the Americas. Sources: Company disclosures.

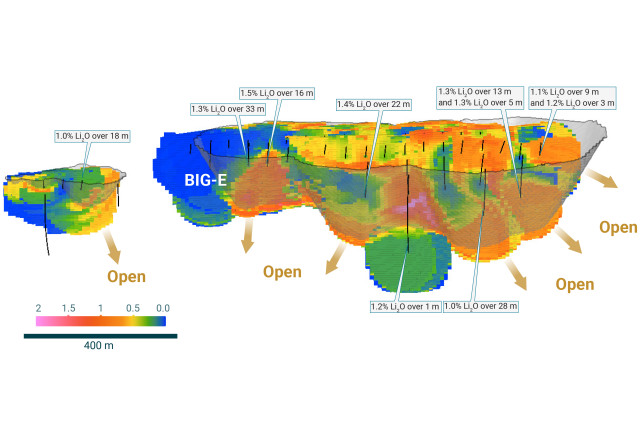

Figure 3 - 8 of 13 resource pegmatites dykes with 2024 drilling plotted. The initial MRE was calculated from 286 drill holes or 49,548m of drilling, using 126 three-dimensional ("3D") pegmatite geology models constructed from surface mapping and drill core logging.

Figure 4 - Isometric views of the eight in-pit resource estimates at the Yellowknife Lithium Project. The resource blocks were calculated using Li assay data from 286 drill holes, within 126 three-dimensional ("3D") pegmatite geology bodies representing the Big East, Big West, Fi Main, Fi SW, Nite, Shorty, Echo and Ki pegmatite deposits.

|

| |

|

|

See Appendix A for references

Table 3 -Yellowknife Lithium Project Deposit Cut-Off Grade Sensitivity

Figure 5 - Isometric long section of the Big-E resource block model and pit, looking southeast. The limits of drilling are defined by some of the strongest intercepts of spodumene mineralization on the project to date, demonstrating the potential for considerable future resource growth. In addition to Big-E, 5 more dykes have unconstrained mineralization all with the potential to significantly increase the collective resource base at the YLP.

Initiation of Preliminary Economic Assessment

In association with the MRE and metallurgical test work completed over the last year (see press release dated September 23, 2024), LIFT initiated a PEA for the Yellowknife Lithium Project and anticipates completion within the first half of 2025.

Qualified Person

The disclosure in this news release of scientific and technical information regarding LIFT's mineral properties has been reviewed and approved by Ron Voordouw, Ph.D., P.Geo., Partner, Director Geoscience, Equity Exploration Consultants Ltd., and a Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101) and member in good standing with the Northwest Territories and Nunavut Association of Professional Engineers and Geoscientists (NAPEG) (Geologist Registration number: L5245).

About LIFT

LIFT is a mineral exploration company engaged in the acquisition, exploration, and development of lithium pegmatite projects located in Canada. The Company's flagship project is the Yellowknife Lithium Project located in Northwest Territories, Canada. LIFT also holds three early-stage exploration properties in Quebec, Canada with excellent potential for the discovery of buried lithium pegmatites, as well as the Cali Project in Northwest Territories within the Little Nahanni Pegmatite Group.

For further information, please contact:

Francis MacDonald Daniel Gordon

Chief Executive Officer Investor Relations

Tel: +1.604.609.6185 Tel: +1.604.609.6185

Email: info@li-ft.com Email: investors@li-ft.com

Website: www.li-ft.com

Appendix A: References

Patriot Battery Metals Inc. - SKWN

"NI 43-101 Technical Report - Mineral Resource Estimate for the CV5 Pegmatite, Corvette Property" effective June 25, 2023; Todd McCracken, P.Geo, Ryan Cunningham, M.Eng., P.Eng, et al.; Inferred: 109.2 Mt at 1.02% Li2O

"NI 43-101 Technical Report Preliminary Economic Assessment for the Shaakichiuwaanaan Project" effective August 21, 2024; Todd McCracken, P.Geo, Ryan Cunningham, M.Eng., P.Eng, et al.; Indicated: 80.1 Mt at 1.44% Li2O, Inferred: 62.5 Mt at 1.31% Li2O

Winsome Resources Limited - Adina

"Globally significant maiden Mineral Resource of 59Mt at 100% owned Adina Lithium Project" effective December 11, 2023; Inferred: 58.5 Mt at 1.62% Li2O

"Adina Mineral Resource increases 33% to 78Mt at 1.15% Li2O with 79% Indicated" effective May 28, 2024; Indicated: 61.4 Mt at 1.14% Li2O, Inferred: 16.5 Mt at 1.19% Li2O

Nemaska Lithium - Whabouchi

"NI 43-101 Technical Report Mineral Resource Estimation Whabouchi Lithium Deposit Nemaska Exploration Inc." effective July 14, 2010; André Laferrière, M.Sc. P.Geo, et al.; Measured: 1.9 Mt at 1.60% Li2O, Indicated: 7.9 Mt at 1.64% Li2O, Inferred: 15.4 Mt at 1.57% Li2O

"Pre-Feasibility Study on the Whabouchi Mine Nemaska, Quebec" effective December 31, 2022; Jeffrey Cassoff, Daniel M. Gagnon, Marc-Antoine Laporte, et al.; Proven: 10.5 Mt at 1.40% Li2O, Probable: 27.7 Mt at 1.28% Li2O, Indicated (exclusive): 7.8 Mt at 1.61% Li2O, Inferred: 8.3 Mt at 1.31% Li2O

Critical Elements Lithium Corporation - Rose

"The Rose deposit is one of the largest resources of "conflict free" Tantalum, with a new indicated resource of 26,500,000 tonnes at 1.30% Li2Oeq or 0.98% Li2O, 163 ppm Ta2O5" effective July 27, 2011; Indicated: 26.5 Mt at 1.30% Li2O, Inferred: 10.7 Mt at 1.14% Li2O

"Critical Elements Lithium Announces New Positive Feasibility Study for the Rose Lithium Project Generating an After-Tax NPV8% of US$2.2B and an After-Tax IRR of 65.7%" effective August 1, 2023; Probable: 26.3 Mt at 0.87% Li2O, Indicated: 30.6 Mt at 0.93%, Inferred: 2.4 Mt at 0.78% Li2O

Arcadium Lithium plc - Galaxy

"Mineral Resource Evaluation James Bay Lithium Project, James Bay, Quebec, Canada" effective November 18, 2010; Sébastien Bernier, P.Geo, et al.; Indicated: 11.8 Mt at 1.30% Li2O, Inferred: 10.5 Mt at 1.20% Li2O

"SEC Technical Report Summary Allkem Limited James Bay Lithium Project" effective June 30, 2023; SLR Consulting (Canada) Ltd., Wave International Pty Ltd., WSP Canada Inc., et al.; Probable: 37.3 Mt at 1.27% Li2O, Indicated: 54.3 Mt at 1.30% Li2O, Inferred: 55.9 Mt 1.29% Li2O

Frontier Lithium Inc. - PAK

"Frontier Lithium expands its PAK Lithium project with Maiden Resource Estimate for the Spark Pegmatite including 3.2 Mt in indicated and 12.2 Mt in the inferred categories" effective February 4, 2020; Indicated: 3.2 Mt at 1.59% Li2O, Inferred: 12.2 Mt at 1.36% Li2O

"Frontier Lithium Inc. Announces Expansion of Spark Deposit - 18.8 Mt in Indicated and 29.7 Mt in Inferred Categories" effective February 28, 2023; Indicated: 18.8 Mt at 1.52% Li2O, Inferred: 29.7 Mt at 1.34% Li2O

Rock Tech Lithium Inc. - Georgia Lake

"Preliminary Economic Assessment for an Integrated Lithium Hydroxide Operation from the Georgia Lake Lithium Project, Northwest Ontario, Canada"; effective March 15, 2021; Ryan James Hanrahan, BEng (Hons), Chris Larder, FAusIMM, Karl Stephan Peters, EurGeol 787, et al.; Measured: 2.3 Mt at 1.04% Li2O, Indicated: 4.3 Mt at 0.99% Li2O, Inferred: 6.7 Mt at 1.16% Li2O

"Rock Tech Lithium completes Pre-Feasibility Study for its Georgia Lake Project" effective July 31, 22; Indicated: 10.6 Mt at 0.88% Li2O, Inferred: 4.2 Mt at 1.00% Li2O

Snow Lake Resources Ltd. - Snow Lake

"Nova Minerals - Quarterly Activities Report - 30 June 2021" effective June 3, 2021; Indicated: 9.0 Mt at 1.00% Li2O, Inferred: 2.0 Mt at 0.98% Li2O

"Snow Lake Announces Completion and Release of S-K 1300 Technical Report Summary of Initial Assessment of the Snow Lake Lithium Project" effective August 10, 2023; Measured: 0.7 Mt at 1.13% Li2O, Indicated: 6.6 Mt at 1.10% Li2O, Inferred: 1.0 Mt at 0.99% Li2O

Cygnus Metals Limited - Pontax

"Maiden Resource of 10.1Mt at 1.04% Li2O with mineralisation open in all directions" effective August 14, 2023; Inferred: 10.1 Mt at 1.04% Li2O

Grid Metals Corp. - Donner

"Grid Metals Announces Maiden Mineral Resource at Donner Lake Lithium Property; Lease Agreement Signed for True North Mill Provides Additional Flexibility for Future Lithium Production" effective June 27, 2023; Inferred: 6.8 Mt at 1.39% Li2O

Critical Resources Limited - Mavis Lake

"8.0 Mt at 1.07% Li2O Maiden Mineral Resource at Mavis Lake" effective May 5, 2023; Inferred: 8.0 Mt at 1.07% Li2O

Green Technology Metals Limited - Seymour Lake

"Substantial Increase in Mineral Resources at Seymour Lake" effective March 6, 2019; Indicated: 2.1 Mt at 1.29% Li2O, Inferred: 2.7 Mt at 1.24% Li2O

"Seymour Resource Confidence Increased Ahead of Preliminary Economic Assessment" effective November 17, 2023; Indicated: 6.1 Mt at 1.25% Li2O, Inferred: 4.1 Mt at 0.70%

Green Technology Metals Limited - Root Lake

"GT1 Mineral Resources Increased to 14.4Mt" effective April 19, 2023; Inferred: 4.5 Mt at 1.01% Li2O

"Significant Resource and Confidence Level Increase at Root, Global Resource Inventory now at 24.5Mt" effective October 17, 2023; Indicated: 9.4 Mt at 1.30% Li2O; Inferred: 45.2 Mt at 1.03% Li2O

International Lithium Corp. - Raleigh Lake

"International Lithium Announces Maiden Mineral Resource Estimate at the Raleigh Lake Lithium Project, Ontario, Canada" effective February 16, 2023; Measured: 0.08 Mt at 0.83% Li2O, Indicated: 2.2 Mt at 0.64% Li2O, Inferred: 3.9 Mt 0.58% Li2O

Imagine Lithium Inc. - Jackpot

"Infinite Ore Adds to Historical Resources on Jackpot Lithium Project" effective January 27, 2021; Inferred: 2.8 Mt at 1.17% Li2O

"Imagine Lithium Releases Initial Mineral Resource at Jackpot Property - Announces 3.1 Mt at 0.85% Li2O Indicated and 5.3 Mt at 0.91% Li2O Inferred Mineral Resources" effective September 3, 2024; Indicated: 3.1 Mt at 0.85% Li2O, Inferred: 5.3 Mt at 0.91% Li2O

Vision Lithium Inc. - Sirmac

"Vision Lithium PEA On Sirmac Boasts A Pre-Tax 83.9% IRR, C$183m Pre-Tax NPV5% And Less Than One Year Payback" effective January 23, 2023; Measured: 0.2 Mt at 1.38% Li2O, Indicated: 0.1 Mt at 1.39% Li2O, Inferred: 0.05 Mt at 1.05% Li2O

Cautionary Statement Regarding Forward-Looking Information

Certain statements included in this press release constitute forward-looking information or statements (collectively, "forward-looking statements"), including those identified by the expressions "anticipate", "believe", "plan", "estimate", "expect", "intend", "may", "should" and similar expressions to the extent they relate to the Company or its management. The forward-looking statements are not historical facts but reflect current expectations regarding future results or events. This press release contains forward looking statements. These forward-looking statements and information reflect management's current beliefs and are based on assumptions made by and information currently available to the company with respect to the matter described in this new release.

Forward-looking statements involve risks and uncertainties, which are based on current expectations as of the date of this release and subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Additional information about these assumptions and risks and uncertainties is contained under "Risk Factors" in the Company's latest annual information form filed on March 27, 2024, which is available under the Company's SEDAR+ profile at www.sedarplus.ca, and in other filings that the Company has made and may make with applicable securities authorities in the future. Forward-looking statements contained herein are made only as to the date of this press release and we undertake no obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law. We caution investors not to place considerable reliance on the forward-looking statements contained in this press release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Note for U.S. Investors Concerning Mineral Resources and Reserves

NI 43-101 is a rule of the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Technical disclosure contained in this news release has been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Classification System. These standards differ from the requirements of the U.S. Securities and Exchange Commission ("SEC") and resource information contained in this news release may not be comparable to similar information disclosed by domestic United States companies subject to the SEC's reporting and disclosure requirements.

Contact Information

Francis MacDonald

CEO

francis@li-ft.com

1.604.609.6185

Daniel Gordon

Investor Relations Manager

daniel@li-ft.com

1.604.609.6185

SOURCE: Li-FT Power

View the original press release on accesswire.com

source : webdisclosure.com