MERIDIAN MINING UK S (:MNO) Meridian Mining Provides Post Financing Activities Outlook for Cabaçal

Transparency directive : regulatory news

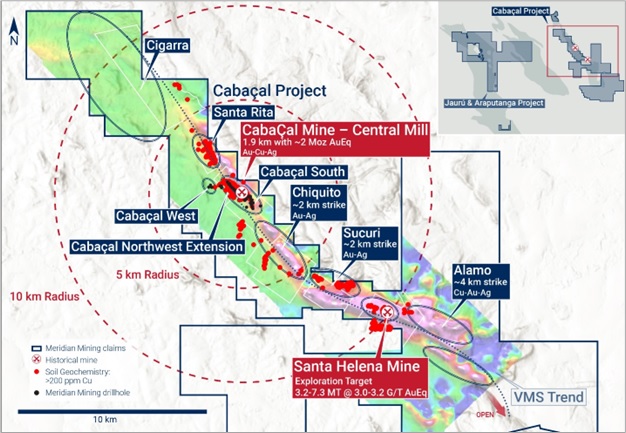

LONDON, UK / ACCESSWIRE / April 23, 2024 / Meridian Mining UK. S ( TSX:MNO )(Frankfurt/Tradegate: 2MM )(OTCQX: MRRDF ) ("Meridian" or the "Company") is pleased to provide a forecast of its activities through to the end of 2024, at its advanced Cabaçal copper-gold-silver VMS project in Mato Grosso Brazil. After the successful completion of the recent CAD20.125M financing[1] Meridian is now well funded to complete the drilling and engineering programs required for the Cabaçal Mine's Pre-Feasibility Study[2] ("PFS"). The Company is also reporting the launch of Santa Helena's next phase of resource drilling and the first phase of metallurgical studies. In parallel to the Cabaçal and Santa Helena programs, the Company's ongoing copper and gold exploration programs are testing the greater Cabaçal belt's prospectivity (Figure 1). Drilling continues and assay results are pending.

Mr. Gilbert Clark, CEO, comments: "With the closing of the institutional led financing delivering a strong balance sheet, we are now accelerating multiple programs at our advanced Cabaçal Cu-Au-Ag VMS project. After the rain impacted Q1, we are mobilizing more rigs to rapidly close off and deliver the Cabaçal Mine's drillhole database to our QP in early Q3, with Santa Helena's following later in the quarter. To complete this, we will shortly have five drill rigs turning with three of these on double shifts, split between the two deposits. For Cabaçal's PFS, we are working with our engineering groups to advance the mining, metallurgical, geotechnical and other studies to take the mill through-put from 2.5Mt p.a for years 1 to 4, and then expand this to 4.5Mt p.a.. At Santa Helena, our geology and geophysical teams have been modelling and refining the Au-Cu-Ag & Zn mineralization for this next phase of drilling. Two low-impact rigs will shortly be drilling this deposit, including targeting the multiple strong off-hole geophysical conductors.

Looking to the future, we have advanced our exploration activities via geochemical and geophysical programs, to aid in drilling these prospects through out 2024. As we continue the evaluation and validation of historical records, we believe there is a tremendous untapped upside, beyond what we have established at Cabaçal and Santa Helena, yet to be delineated".

Key Activities for 2024

- Meridian accelerates Cabaçal's drill programs following completion of recent financing;

- Five diamond drill rigs mobilized for accelerated 7,800m summer drill program;

- Complete Cabaçal's PFS drill program in Q2;

- Delivery Santa Helena's drill hole data base in Q3;

- Five diamond drill rigs mobilized for accelerated 7,800m summer drill program;

- Cabaçal's PFS mining, metallurgical and engineering studies continue to advance;

- Santa Helena's metallurgical program in preparation;

- Exploration drilling programs to be expanded through out the year; and

- Multiple soil and stream geochemical targets for gold and base metals continue to be unlocked.

Figure 1: Cabaçal project targets.

Expansion of Cabaçal's Drill Programs

Cabaçal Mine Cu-Au-Ag

The Company is pleased to report that it is accelerating its drill program targeting the copper-gold-silver rich Cabaçal Mine. The now accelerated PFS drill program continues, with a combination of infill drilling, targeted drilling in the mine area and the twinning of historical drill records that have not been recovered. These include historical drill plans in which visible gold is logged but the associated assay data has not been recovered. After the PFS's immediate drill priorities[3] are concluded over the coming months, exploratory drilling will be conducted in down-dip and down-plunge areas of the Cabaçal deposit. The Company has identified that structural features of Cabaçal's host rocks, such as repeats in kinks or flexures may create addition favourable environments for the gold overprint, along with the possibility of other early rift-related sulphide accumulations, these are zones flagged for follow-up drilling. A broad expanse of Cabaçal's prospective and open upside remains to be tested, and results may assist in optimizing location of mine related surface infrastructure.

The metallurgical and engineering aspects of the PFS preparations are ongoing while the larger part of the study will commence once the draft resource has been delivered in Q4. Todate the company is pleased with the ongoing results from the metallurgical studies.

Santa Helena Mine Au-Cu-Ag & Zn

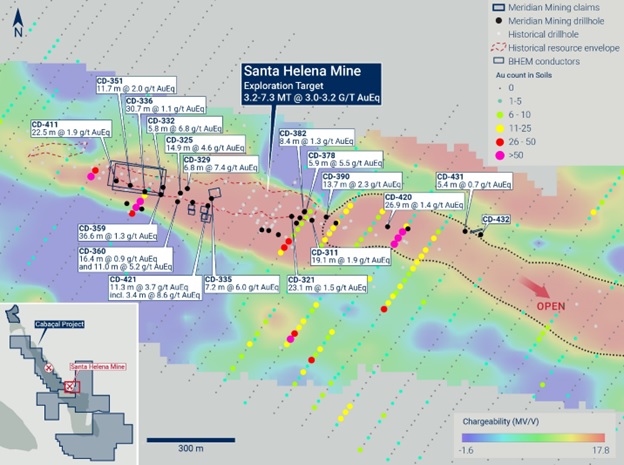

Drilling has now recommenced at the Santa Helena Au-Cu-Ag & Zn mine. A second rig is being mobilized to fast-track Santa Helena's second phase of resource definition drilling, for which the Company has estimated an Exploration Target in the range of 3.2 - 7.2 Mt @ 3.0 - 3.2g/t AuEq[4]. The Company initially completed thirty holes for 1730m, with drilling results from the 2023 program demonstrating high-grade intersections over the core area of the deposit, and strong mineralization in its up-dip extensions; all at open pitable depths. An unexpected second horizon of mineralization[5] has further expanded the upside potential of the mineralized envelope, and will be further tested with ongoing drilling. Santa Helena's potential to provide high-grade mineralization to a central processing hub will be quantified with its inaugural 2024 resource statement.

Santa Helena's drill results to date have shown a good correlation between the mine horizon hosting the Au-Cu-Ag & Zn mineralization and the ~3km chargeability response seen in the IP survey. Meridian's drilling has only partially covered the IP anomaly. The last reported results: CD-421: 11.3m @ 3.7g/t AuEq from 35.0m, including: 3.4m @ 8.6g/t AuEq from 42.9m[6], confirmed that it remains open outside of the historical resource envelope. The Company plans to infill and expand the definition of the mine horizon further across strike and to the east.

The Company also completed a bore-hole geophysical program ("BHEM") during the drilling recess, including surveys on the first holes drilled into the 2km chargeability corridor extending to the east of the Santa Helena mine area. BHEM surveys of CD-431 and CD-432 returned a modelled conductor extending over 40m+ in strike, with a high conductivity (~4200 Siemens), and located below and in-between the two drill holes (Figure 2). This is the strongest BHEM response detected to date at Santa Helena. Drill testing of this conductor will form part of the ongoing program of exploration for extensions, or satellite discoveries along this eastern projection of the Santa Helena mine horizon.

An important part of this drill program will be to recover a sufficient mass of Santa Helena's Au-Cu-Ag & Zn mineralization for the first round of metallurgical testwork that will determine the metal recoveries and associated flow sheet. The mineralization to be tested will include the oxide-transition zone, massive sulphide and stringer mineralization, to generate a representative sample of material from open pit depths. An important component of this program, that was not part of the historical flow sheet, is the addition of testwork for gravity separation of gold. The Company sees the potential for four products from Santa Helena's mineralization: gold doré, copper concentrates with high gold & silver credits, zinc concentrates, and a silver-gold rich lead concentrate. The scope of works for this testwork is in preparation with a timeframe for first results in late Q4.

Figure 2: Santa Helena drilling and BHEM conductors.

Cabaçal Exploration Expansion

The Company has focused its land access programs on some of the most prospective historical copper and gold occurrences where extensive anomalies were identified. These are largely untested by drilling and provide an immediate pipeline of targets to test for potential new discoveries.

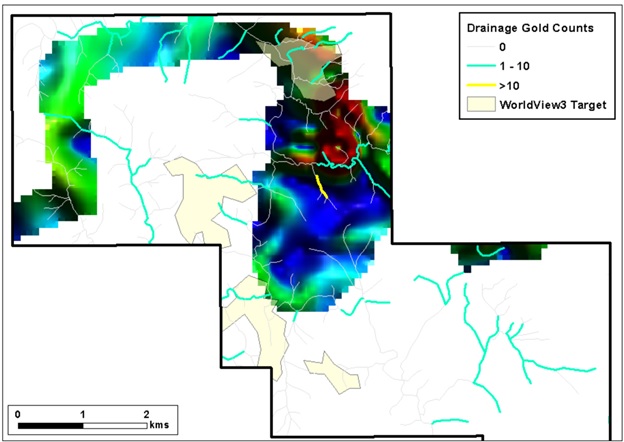

Gravity survey reconnaissance work has been undertaken to gather an initial layer of geophysical data in the Cigarra area (Figure 3). Gold in drainage responses show some alignment with target areas defined by the Company's WorldView 3 satellite survey. The peak gold response is similar in threshold to that at Cabaçal (Cigarra: peak gold of 13 counts; Cabaçal; peak of 14 counts). Some contrast is seen in the gravity response which remains under interpretation, but may potentially be influenced by hydrothermal alteration halos.

As the wet season abates, surface programs will include ground geophysics over the open western extension to Santa Helena. The Company has conducted soil sampling in this area where gaps in coverage existed in the BP Minerals sampling. 200 samples have been collected and have outlined a new Cu anomaly ~ 4km to the west of Santa Helena, extending over ~575m at a 150ppm threshold. Gold assay results for this soil anomaly have returned a peak of 60ppb, with the response open. The area and its extensions will be targeted first with an induced polarization survey, which is proving an effective technique in the area for near surface targeting, followed by deeper seeking surface electromagnetic survey methods.

Figure 3: Initial gravity data with gold in drainage responses in the Cigarra area.

Data gathering and review programs are ongoing over the broader suite of exploration applications, with compilation of stream survey data well advanced and future work to focus on registration of prospect-scale mapping and soil surveys over targets in the broader district.

About Meridian

Meridian Mining UK S is focused on:

- The development and exploration of the advanced stage Cabaçal VMS gold‐copper project;

- Regional scale exploration of the Cabaçal VMS belt; and

- Exploration in the Jaurú & Araputanga Greenstone belts (the above all located in the State of Mato Grosso, Brazil).

Cabaçal is a gold-copper-silver rich VMS deposit with the potential to be a standalone mine within the 50km VMS belt. Cabaçal's base and precious metal-rich mineralization is hosted by volcanogenic type, massive, semi-massive, stringer, and disseminated sulphides within deformed metavolcanic-sedimentary rocks. A later-stage gold overprint event has emplaced high-grade gold mineralization.

The Preliminary Economic Assessment technical report (the "PEA Technical Report") dated March 30, 2023, entitled: "Cabaçal Gold-Copper Project NI 43-101 Technical Report and Preliminary Economic Assessment, Mato Grosso, Brazil" outlines a base case after-tax NPV5 of USD 573 million and 58.4% IRR from a pre-production capital cost of USD 180 million, leading to capital repayment in 10.6 months (assuming metals price scenario of USD 1,650 per ounces of gold, USD 3.59 per pound of copper, and USD 21.35 per ounce of silver). Cabaçal has a low All-in-Sustaining-Cost of USD 671 per ounce gold equivalent for the first five years, driven by high metallurgical recovery, a low life-of-mine strip ratio of 2.1:1, and the low operating cost environment of Brazil (see press release dated March 6, 2023).

The Cabaçal Mineral Resource estimate consists of Indicated resources of 52.9 million tonnes at 0.6g/t gold, 0.3% copper and 1.4g/t silver and Inferred resources of 10.3 million tonnes at 0.7g/t gold, 0.2% copper & 1.1g/t silver (at a 0.3 g/t gold equivalent cut-off grade), including a higher-grade near-surface zone supporting a starter pit.

Readers are encouraged to read the PEA Technical Report in its entirety. The PEA Technical Report may be found on the Company's website at www.meridianmining.co and under the Company's profile on SEDAR+ at www.sedarplus.ca .

The qualified persons for the PEA Technical Report are: Robert Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering), Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering), Simon Tear (PGeo, EurGeol), Principal Geological Consultant of H&SC, Marcelo Batelochi, (MAusIMM, CP Geo), Geological Consultant of MB Geologia Ltda, Joseph Keane (Mineral Processing Engineer; P.E), of SGS, and Guilherme Gomides Ferreira (Mine Engineer MAIG) of GE21 Consultoria Mineral.

On behalf of the Board of Directors of Meridian Mining UK S

Mr. Gilbert Clark - CEO and Director

Meridian Mining UK S

Email: info@meridianmining.co

Ph: +1 778 715-6410 (PST)

Stay up to date by subscribing for news alerts here: https://meridianmining.co/contact/

Follow Meridian on Twitter: https://twitter.com/MeridianMining

Further information can be found at: www.meridianmining.co

Technical Notes

Soils samples have been analysed at the accredited SGS laboratory in Belo Horizonte. gold analyses have been conducted by FAA505 (fire assay of a 50g charge), and base metal analysis by portable XRF calibrated with certified references. ~10% of base metal results are verified by laboratory analysis at SGS using methods ICP40B (four acid digest with ICP-OES finish). Samples are held in the Company's secure facilities until dispatched and delivered by staff and commercial couriers to the laboratory. Pulps are retained for umpire testwork, and ultimately returned to the Company for storage. The Company submits a range of quality control samples, including blanks and gold and polymetallic standards supplied by ITAK and OREAS, supplementing laboratory quality control procedures.

The "gold counts" referenced in the soil geochemistry figure is a measure of the number of gold grains visually counted in a pan concentrate from a set volume of material: a 5-litre bucket of basal sediment, providing a qualitative indicator of the presence of gold in a sample.

Qualified Person

Mr. Erich Marques, B.Sc., MAIG, Chief Geologist of Meridian Mining and a Qualified Person as defined by National Instrument 43-101, has reviewed, and verified the technical information in this news release.

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors" in Meridian's most recent Annual Information Form filed on www.sedarplus.ca . While these factors and assumptions are considered reasonable by Meridian, in light of management's experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

[1] See Meridian news release dated April 9 th , 2024

[2] See Meridian news release dated January 1 st , 2024

[3] See Cabaçal Technical Report - NI-43-101 - March 2023: https://meridianmining.co/investors/

[4] See Meridian news release dated December 5, 2023

[5] Meridian news release dated January 10 th , 2024

[6] Meridian news release dated March 4 th , 2024

SOURCE: Meridian Mining UK S

View the original press release on accesswire.com

source : webdisclosure.com