THERALASE TECHNOLOGIES, INC. (:TLT) Theralase(R) Release’s 3Q2024 Financial Statements

Transparency directive : regulatory news

TORONTO, ON / ACCESSWIRE / November 27, 2024 / Theralase® Technologies Inc. (" Theralase® " or the " Company ") (TSXV:TLT)(OTCQB:TLTFF), a clinical stage pharmaceutical company dedicated to the research and development of light, radiation, sound and drug-activated small molecules and their formulations, intended for the safe and effective destruction of various cancers, bacteria and viruses has released the Company's unaudited condensed consolidated interim financial statements for the nine-month period ended September 30, 2024. (" Financial Statements ").

Theralase® will be hosting a conference call on Wednesday December 4 th at 11:00 am ET , which will include a presentation of the financial and operational results for the nine-month period ended September 30, 2024. Questions are welcome. To ensure Theralase® has time to review and properly address them during the call, please send them in advance to mperraton@theralase.com .

Zoom Meeting Link: https://us02web.zoom.us/j/84816819001

Conference Call in: 1-647-558-0588 (Canada) / 1-646-558-8656 (US) - not required for those attending by Zoom.

An archived version will be available on the website following the conference call.

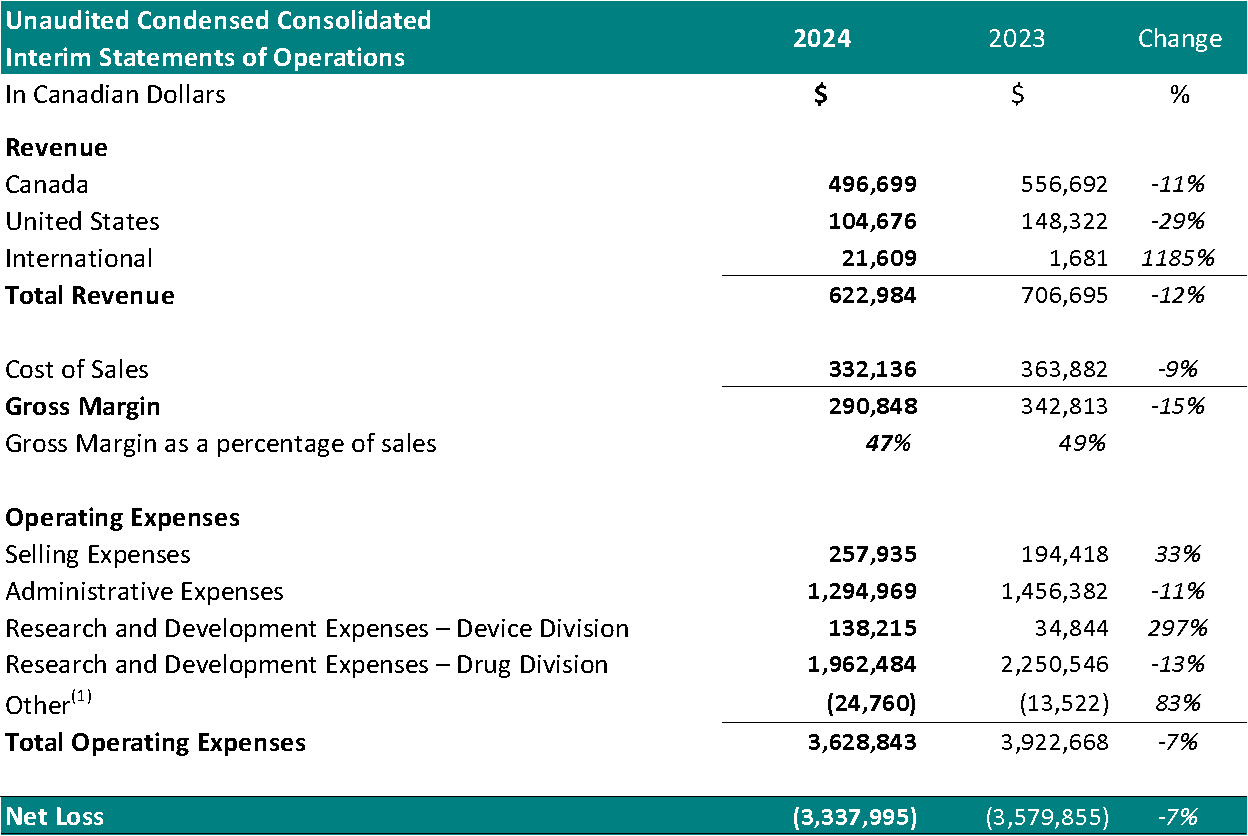

Financial Summary:

For the nine-month period ended September 30 th :

1 Other represents foreign exchange, interest accretion on lease liabilities and / or interest income

Financial Highlights

For the nine-month period ended September 30, 2024;

Total revenue decreased 12%, year over year.

Cost of sales was $332,136 (53% of revenue) resulting in a gross margin of $290,848 (47% of revenue). In comparison, the cost of sales for the same period in 2023 was $363,882 (51% of revenue) resulting in a gross margin of $342,813 (49% of revenue). The gross margin increase, as a percentage of sales year over year, is attributed to an increase in sales in the third quarter.

Selling expenses increased to $257,935, from $194,418 for the same period in 2023, a 33% increase. The increase in selling expenses is a result of increased spending in sales salaries (55%), and advertising (54%).

Administrative expenses decreased to $1,294,969 from $1,456,382 for the same period in 2023, an 11% decrease. The decrease in administrative expenses is a result of reduced spending on general and administrative expenses (45%), professional fees (22%) and stock-based compensation (26%) (due to the cumulative effect of accounting for the vesting of stock options granted in the current and previous years).

Net research and development expenses for the Drug Division decreased to $1,962,484 from $2,250,346 for the same period in 2023, a 13% decrease. The decrease is primarily attributed to a decrease in costs for Study II patient enrollment and treatment.

Net research and development expenses for the Device Division increased to $138,215 from $34,844 for the same period in 2023, a 297% increase. The increase is attributed to development of a new software program for the TLC-2000 Cool Laser Therapy system.

The net loss for the nine-month period ended September 30, 2024, was $3,337,995 which included $562,353 of net non-cash expenses (i.e.: amortization, stock-based compensation expense and foreign exchange gain/loss). This compared to a net loss in 2023 of $3,579,855, which included $714,020 of net non-cash expenses. The Drug Division represented $2,810,423 of this loss (84%) in 2024. The decrease in net loss is primarily attributed to decreased spending on research and development expenses in Study II.

Operational Highlights:

Non-Brokered Private Placement:

On February 5, 2024, the Company closed a non-brokered private placement of units. On closing, the Company issued an aggregate of 6,666,670 units at a price of $CAN 0.18 per Unit for aggregate gross proceeds of approximately $CAN 1,200,000 of which 1,310,502 units were purchased by certain insiders of the Corporation, representing gross proceeds of $235,890. Each Unit consisted of one common share of the Company and one non-transferable warrant. Each Warrant entitles the holder to acquire an additional Common Share at a price of $CAN 0.25 for a period of 5 years following the date of issuance.

On April 24, 2024, the Company closed a non-brokered private placement of units. On closing, the Company issued an aggregate of 4,167,778 units at a price of $0.18 per Unit for aggregate gross proceeds of approximately $750,200. Each Unit consisted of one common share of the Company and one non-transferable common share purchase warrant. Each Warrant entitles the holder to acquire an additional Common Share at a price of $0.25 for a period of 5 years following the date of issuance.

On July 8, 2024, the Company closed a non-brokered private placement of units. On closing, the Company issued an aggregate of 3,522,729 units at a price of $0.22 per Unit for aggregate gross proceeds of approximately $775,000. Each Unit consisted of one common share of the Company and one non-transferable common share purchase warrant. Each Warrant entitles the holder to acquire an additional Common Share at a price of $0.30 for a period of 5 years following the date of issuance.

On September 24, 2024, the Company closed a non-brokered private placement of units. On closing, the Company issued an aggregate of 2,720,000 units at a price of $0.20 per Unit for aggregate gross proceeds of approximately $544,000. Each Unit consisted of one common share of the Company and one non-transferable common share purchase warrant. Each Warrant entitles the holder to acquire an additional Common Share at a price of $0.30 for a period of 5 years following the date of issuance.

On November 15, 2024, the Company closed a non-brokered private placement of units. On closing, the Company issued an aggregate of 2,221,334 units at a price of $0.30 per Unit for aggregate gross proceeds of approximately $666,400. Each Unit consisted of one common share of the Company and one non-transferable common share purchase warrant. Each Warrant entitles the holder to acquire an additional Common Share at a price of $0.45 for a period of 5 years following the date of issuance.

In 2024 and 2025, the Company plans to secure funding through various equity and debt instruments to allow the Company the ability to become base shelf eligible. This will allow the Company sufficient funding to complete enrollment into Study II in 2025, data lock in mid 2026 and position the Company for FDA and Health Canada approval by the end of 2026, subject to achieving FDA Priority Review."

Warrant Extension

On September 19, 2024, the Company extended the expiry date of 10,000,000 share purchase warrants, all of which are exercisable at $0.35 per share. The share purchase warrants were issued on September 22, 2024, pursuant to a private placement involving the issuance of 10,000,000 units of the Company. The new expiry date of the warrants is September 22, 2027.

On November 12, 2024, the Company extended the expiry date of 1,000,000 share purchase warrants, all of which are exercisable at $0.35 per share. The share purchase warrants were issued on November 17, 2024, pursuant to a private placement involving the issuance of 1,000,000 units of the Company. The new expiry date of the warrants is November 17, 2027.

Study II Update:

On February 8 th , 2024, Dr. Michael Jewett joined the Company in the role of an independent consultant, to assist the Company in the accruement of patients into Study II. Under the terms of the consulting agreement, Dr. Jewett will be responsible for working with existing clinical study sites and helping to onboard new clinical study sites to assist Theralase® to complete enrollment and provide the primary study treatment to 75 to 100 patients in Study II, in 2025.

Study II commenced in April 2019 with an estimated completion time of approximately 8 years and an estimated cost of approximately $CAN 100 million. The timing and cost may vary significantly depending on numerous factors; including: number of Clinical Study Sites (" CSSs ") enrolling and treating patients, patient enrollment rates in total and at each CSS, patient compliance and successful achievement of Study II primary, secondary and tertiary objectives.

Break Through Designation Update:

In 2020, the FDA granted Theralase® Fast Track Designation (" FTD ") for Study II. As a Fast Track designee, Theralase® has access to early and frequent communications with the FDA to discuss Theralase®'s development plans and ensure the timely collection of clinical data to support the approval process. The accelerated communication with the FDA potentially allows, the Study Procedure, to be the first intravesical, patient-specific, light-activated, Ruthenium-based small molecule for the treatment of patients diagnosed with BCG-Unresponsive NMIBC CIS, (with or without recurrent / resected papillary T a /T 1 tumours). FTD can lead to Break Through Designation (" BTD "), Accelerated Approval (" AA ") or Priority Review, if certain criteria are met, which the FDA previously defined to the Company for BTD as clinical data on approximately 20 to 25 patients enrolled and provided the primary Study Procedure, who demonstrate significant safety and efficacy clinical outcomes.

To this list, the FDA has added: Post Study II Monitoring of Response and Central Pathology Laboratory Review, as further defined above.

The Company is currently working with the CSSs, a biostatistics organization and a regulatory organization to update the pre-BTD submission with clinical data clarifications identified by the FDA. The Company plans to resubmit the pre-BTD submission to the FDA in 4Q2024 for FDA review of these clarifications. Once the pre-BTD submission has been accepted by the FDA, the Company plans to compile a BTD submission for review by the FDA in 1Q2025 in support of the grant of a BTD approval.

Theralase® has received the majority of the clinical data from the CSSs with a high percentage of patients showing a duration of their CR beyond 450 days, with some patients demonstrating CR for up to ≥ 3 years, post receiving the primary Study Procedure.

Study II Preliminary Clinical Data :

To date, Theralase® has enrolled and treated 75 patients in Study II, who have been provided the primary Study Procedure by the CSSs.

Theralase® plans to add up to 5 new CSSs in 4Q2024/1Q2025, as well as increase enrollment at the existing 10 CSSs to complete Study II accruement in 2025.

96% (72/75) of treated patients have been evaluated at the 90 days assessment for treatment safety and efficacy according to the clinical study protocol.

84% (63/75) of treated patients have completed the clinical study for treatment safety and efficacy according to the clinical study protocol by being assessed up to 450 days or by being removed from Study II.

Performance to Primary Objective:

For the primary endpoint of Study II (CR at any point in time) 61.9% (39/63) [42.5, 81.3] of patients provided the Study Procedure (Study Drug activated by the Study Device) demonstrated a CR (negative cystoscopy and negative urine cytology; positive cystoscopy (low grade) and negative cytology or negative cystoscopy and suspicious / positive urine cytology with confirmed upper tract / prostatic urethra disease and negative bladder biopsies). Including patients, who demonstrated an IR (negative cystoscopy and positive or suspicious urine cytology), the TR increases to 68.3% (43/63) [47.9, 88.7].

This represents that greater than 2 out of 3 BCG-Unresponsive NMIBC CIS patients treated with Theralase®'s unique Study Procedure are demonstrating complete destruction of the cancer in their bladder.

| Primary Endpoint Performance (CR at any Point in Time) |

| ||||||||||

|

| # |

|

| % |

|

| Confidence Interval (95%) |

| |||

Complete Response ("CR") |

|

| 39 |

|

|

| 61.9 | % |

|

| (42.5, 81.3 | ) |

Total Response (CR and IR) |

|

| 43 |

|

|

| 68.3 | % |

|

| (47.9, 88.7 | ) |

Performance to Secondary Objective:

For the secondary endpoint of Study II (duration of CR) 43.6% (17/39) [22.9, 64.3] of treated patients who achieved a CR, maintained their CR response for at least 12 months (450 days from date of Study Procedure).

| Secondary Endpoint Performance (Duration of CR) (450 Days) |

| ||||||||||

|

| # |

|

| % |

|

| Confidence Interval (95%) |

| |||

Complete Response ("CR") |

|

| 17 |

|

|

| 43.6 | % |

|

| (22.9, 64.3 | ) |

Performance to Tertiary Objective:

For the tertiary endpoint of Study II (safety of Study Procedure) 100% (63/63) experienced no Serious Adverse Events (" SAEs ") directly related to the Study Drug or Study Device.

| Tertiary Endpoint Performance (Safety) (450 Days) |

| ||||||

|

| # |

|

| % |

| ||

Safety |

|

| 63 |

|

|

| 100.0 | % |

In addition, 15.4% (6/17) [3.1, 27.7] of patients who demonstrated a CR at 450 days, continue to demonstrate a CR at 24 months from date of first treatment (5 patients are still pending assessment) and 10.3% (4/17) [0.2, 20.4] of patients continue to demonstrate a CR at 36 months from date of first treatment (8 patients are still pending assessment).

Note: For patients to be included in the statistical clinical analysis they must be enrolled in Study II, provided the primary Study Procedure and evaluated by a PI at the 90 days assessment through to 450 days assessment (cystoscopy and urine cytology) or have been removed from Study II, prior to the 450 day assessment. One patient passed away prior to their 90 days assessment and is therefore not included in the efficacy statistical analysis, only in the safety statistical analysis; therefore, there are 63 patients that have completed Study II and have been statistically analyzed for safety and efficacy and 1 patient analyzed only for safety. Evaluable Patients are defined as patients who have been evaluated by a PI and thus exclude a patient's clinical data at specific assessment days, if that clinical data is pending. 12 out of a total of 75 patients have been enrolled and provided the primary Study Procedure, but have not been evaluated through to their 450 days assessment (or have been removed from Study II, prior to the 450 day assessment); therefore, 63 patients are considered Evaluable Patients. The data analysis presented above should be read with caution, as the clinical data is interim in its presentation. Study II is ongoing and new clinical data collected may or may not continue to support the current trends, with clinical data still pending.

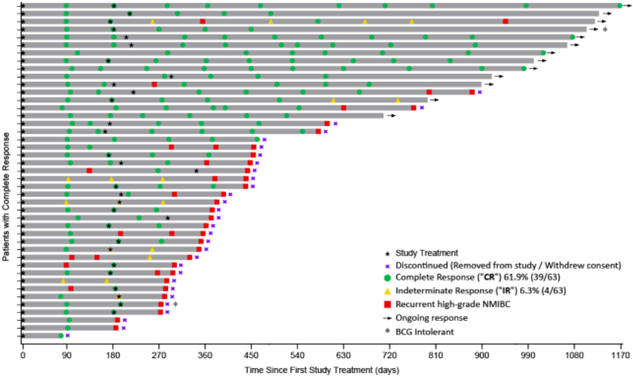

Patient Response Chart:

The Swimmer's plot is a graphical representation of the interim clinical results (n=43) for patients who achieved a CR or IR at any point in time and their response up to and including ≥ 3 years (1080 days), graphically demonstrating a patient's response to a treatment over time. As can be seen in the plot, clinical data is still pending for patients (indicated by arrows), who have demonstrated an initial CR at 90 days and continue to demonstrate a duration of that response.

61.9% (39/63) of Evaluable Patients achieved CR at any point in time, with 43.6% (17/39) of Evaluable patients who demonstrated initial CR continue to demonstrate CR at 450 days and thus achieved the primary and secondary objectives of Study II.

Clinical data is still being collected, but all indications demonstrate that Study II has achieved its primary, secondary and tertiary objectives based on an interim data analysis.

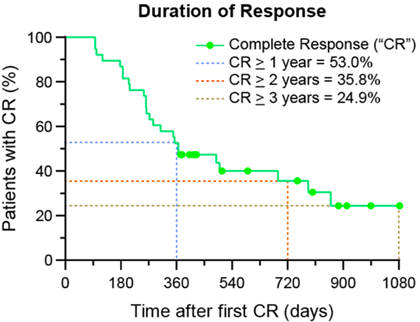

Kaplan-Meier Curve:

The Kaplan-Meier (" KM ") Curve illustrates graphically, for patients who have achieved a CR, the duration of CR and probability of that CR continuing in the future when all clinical data of the Study II will be analyzed.

Note: The information on the time-to-outcome event is not available for all patients in this analysis, as not all patients have been assessed at all available assessment visits. Only patients that achieved the primary objective (CR at any point in time) have been analyzed and data is plotted relative to the date at which their first CR was observed. The green circle denotes censored observations, which means subjects who achieved CR at their last assessment visit and are currently on-study or have been removed from study. Thus, the KM Curve estimates the risk of a patient failing to maintain a CR over time, according to currently available interim data.

In summary, the interim clinical data demonstrates that patients consenting to participate in Study II have a 61.9% chance of achieving CR.

According to the KM Curve, if CR is obtained, then the patient has a ≥ 53.0%, ≥ 35.8% and ≥ 24.9% chance of remaining cancer free for 1, 2, and 3 years, respectively.

Serious Adverse Events

For 75 patients treated in Study II, there have been 15 Serious Adverse Events (" SAEs ") reported:

1 - Grade 1 (resolved within 9 days)

3 - Grade 2 (resolved within 1, 1 and 33 days, respectively)

7 - Grade 3 (resolved within 1, 2, 3, 4, 4, 82 and unknown days, respectively)

3 - Grade 4 (resolved within 3, 6 and 8 days, respectively)

1 - Grade 5

Theralase® believes all SAEs reported to date are unrelated to the Study II Drug or Study II Device.

Note: A SAE is defined as any untoward medical occurrence that at any dose: Is serious or life-threatening, requires inpatient hospitalization or prolongation of existing hospitalization, results in persistent or significant disability/incapacity, is a congenital anomaly/birth defect or results in death.

Dr. Arkady Mandel, M.D., Ph.D., D.Sc., Chief Scientific Officer of Theralase® stated, " The interim clinical data of Study II has proven to be world-class. Study II has demonstrated an ability to destroy urothelial cell carcinoma in a patient's bladder for a Total Response (" TR ") of 68.3%. For patients who are assessed as achieving a Complete Response (" CR "), these patients have demonstrated a duration of that CR of 43.6%, at 450 days. The primary benefits of the Theralase® technology versus competitive technologies are: a urologist-led treatment, a single out-patient procedure, high efficacy rates (patients achieve a CR in 61.9% of the cases with a 43.6% duration of that CR at 450 days), probability of the ongoing duration of that complete response (53.0% demonstrate a CR of ≥ 1 year, 35.8% demonstrate a CR of ≥ 2 years and 24.9% demonstrate a CR of ≥ 3 years, based on the Kaplan-Meier Curve analysis of the interim clinical data) and high safety profile ( no SAEs directly associated with the Study Drug or Study Device); therefore, the Theralase® technology has the opportunity to become a safe, effective alternative therapy for patients, who are at high risk of having their bladder removed. "

Roger DuMoulin-White, B.E.Sc., P.Eng., Pro.Dir., President and Chief Executive Officer of Theralase® stated, " Based on the interim clinical data accumulated to date, Study II has achieved its primary, secondary and tertiary endpoints. To complete the study, Theralase® plans to enroll and treat approximately 20 to 25 patients in 2025. Pending their follow-up in 2026, the clinical data will be submitted to Health Canada and the FDA for marketing approval. The interim clinical data has been able to demonstrate that greater than 2 out of 3 patients (68.3%), treated with the Theralase® technology have been able to have the cancer in their bladder completely destroyed. The Theralase® bladder cancer treatment has been proven clinically to be safe and effective in the treatment of BCG-Unresponsive NMIBC CIS, fulfilling an unmet need of the medical community. "

About Study II:

Study II utilizes the therapeutic dose of the patented Study II Drug (" Ruvidar TM " or " TLD-1433 ") (0.70 mg/cm 2 ) activated by the proprietary Study II Device ( TLC-3200 Medical Laser System or " TLC-3200 "). Study II is focused on enrolling and treating approximately 75 to 100 BCG-Unresponsive NMIBC Carcinoma In-Situ (" CIS ") patients in up to 15 Clinical Study Sites (" CSS ") located in Canada and the United States.

About Ruvidar TM :

Ruvidar TM is a peer reviewed, patented PDC currently under investigation in Study II.

About Theralase® Technologies Inc.:

Theralase® is a clinical stage pharmaceutical company dedicated to the research and development of light activated compounds, their associated drug formulations and the light and/or radiation systems that activate them, with a primary objective of efficacy and a secondary objective of safety in the destruction of various cancers, bacteria and viruses.

Additional information is available at www.theralase.com and www.sedarplus.ca

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements:

This news release contains "forward-looking statements" within the meaning of applicable Canadian securities laws. Such statements include; but, are not limited to statements regarding the Company's proposed development plans with respect to Photo Dynamic Compounds and their drug formulations. Forward looking statements may be identified by the use of the words " may , " should ", " will ", " anticipates ", " believes ", " plans ", " expects ", " estimate ", " potential for " and similar expressions; including, statements related to the current expectations of Company's management for future research, development and commercialization of the Company's Photo Dynamic Compounds and their drug formulations, preclinical research, clinical studies and regulatory approvals.

These statements involve significant risks, uncertainties and assumptions; including, the ability of the Company to: adequately fund and secure the requisite regulatory approvals to commercially market a treatment for bladder cancer in a timely fashion and implement its commercialization strategy. Other risks include: the ability of the Company to successfully complete its Phase II BCG-Unresponsive NMIBC CIS clinical study , access to sufficient capital to fund the Company's operations may not be available or may not be available on terms that are commercially favorable to the Company, the Company's drug formulations may not be effective against the diseases tested in its clinical studies, the Company's fails to comply with the term of license agreements with third parties and as a result loses the right to use key intellectual property in its business, the Company's ability to protect its intellectual property, the timing and success of submission, acceptance and approval of regulatory filings. Many of these factors that will determine actual results are beyond the Company's ability to control or predict.

Readers should not unduly rely on these forward- looking statements, which are not a guarantee of future performance. There can be no assurance that forward looking statements will prove to be accurate as such forward looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results or future events to differ materially from the forward-looking statements.

Although the forward-looking statements contained in the press release are based upon what management currently believes to be reasonable assumptions, the Company cannot assure prospective investors that actual results, performance or achievements will be consistent with these forward-looking statements.

All forward-looking statements are made as of the date hereof and are subject to change. Except as required by law, the Company assumes no obligation to update such statements.

For investor information on the Company, please feel to reach out Investor Inquiries - Theralase Technologies .

For More Information:

1.866.THE.LASE (843-5273)

416.699.LASE (5273)

www.theralase.com

Kristina Hachey, CPA x224

Chief Financial Officer

khachey@theralase.com

SOURCE: Theralase Technologies, Inc.

View the original press release on accesswire.com

source : webdisclosure.com